Discover a unique avenue for philanthropy and charitable endeavours through a Labuan Charitable Foundation. Beyond their role as a versatile wealth management tool, they offer a platform for supporting charitable causes, fostering social responsibility, and making a positive impact on the causes that matter most to you.

Labuan Charitable Foundation is a foundation established by the founder solely for charitable purposes and operates on a non-profit basis. Their functions typically involve donating funds, supporting other non-profit organisations, or utilising their own resources for charitable causes, all aimed at promoting public welfare or other community-beneficial purposes.

Permitted Purposes of a Labuan Charitable Foundation

- The prevention and relief of poverty

- The advancement of religion, profession or education

- The advancement of health for sickness, disease or human suffering

- The community advancement for the aged, disability, children and young people

- The advancement of culture, arts and heritage

- The advancement of an amateur sport that involves physical or mental exertion

- The promotion of human rights, conflict resolution and reconciliation

- The advancement of environmental protection and improvement

- The advancement of animal welfare

- The advancement of recreation facilities or leisure-time occupation for social welfare

Advantages of a Labuan Charitable Foundation

- Low setup and maintenance cost.

- Flexible lifespan of foundation: can be perpetual or a fixed period.

- Muslims may set up Labuan Foundations that are Syariah compliant or otherwise.

- The founder is protected from foreign claims and the foundation cannot be forcefully liquidated to satisfy claims arising from divorce, lawsuit or debts after 2 years. *

- The founder has unlimited and exclusive powers.

- Ability to be redomicile to another jurisdiction of your choice at any time.

- Provisions stated in the constituent documents are permitted to be amended, when needed.

- Fully confidential as no information can be accessed by the public.

- Legal ownership of assets “remains” within the control of the foundation.

- It is a legal entity fully protected by Labuan Foundations Act 2010.*

Under Labuan Foundation Act Section 61, provides prevention from a foreign claim or judgement being enforced against a validly established Foundation. It cannot be forcefully liquidated to satisfy other obligations after 2 years.

Key Features and Operational Requirements of a Labuan Charitable Foundation

- Maintain a registered office in Labuan.

- No capital requirements, only a minimum endowment of USD 1.00 at establishment.

- Legal status as a separate legal entity with rights akin to an individual.

- It has the capability to act as a shareholder in a company.

- It can engage in contractual agreements, purchase and sell properties, hold bank accounts, and possess shares or stakes in other corporations.

- To mitigate risks, it is recommended that any trade activities, if undertaken, be conducted through an underlying company or partnership. Trade or commercial endeavors should remain secondary to its primary purpose, which is the management of its assets.

- Duration of the Labuan Charitable Foundation may be fixed or infinite lifespan.

- Carry on business in any currencies including Malaysian Ringgit except as permitted by the relevant authorities.

- Property ownership solely for foundation purposes as outlined in its charter.

- Allow to endow diverse assets, both Malaysian and non-Malaysian, whether corporeal or incorporeal, tangible or intangible, movable or immovable.

- This includes legal documents or instruments in any form, such as electronic or digital formats, evidencing ownership or interest in assets like bank cheques, money orders, shares, securities, bonds, bank drafts, and letters of credit. The Foundation may hold Malaysian and/or non-Malaysian properties.

- All assets of the Labuan Charitable Foundation are legally and beneficially owned by the Foundation itself and must be utilized solely for the purposes and objectives outlined in the Foundation's charter.

- Malaysian properties endowed to a Labuan Charitable Foundation do not require prior approval from Labuan FSA. Malaysian founders have the freedom to endow Malaysian properties to the Foundation in accordance with Foreign Exchange Administration (FEA) regulations. However, Labuan charitable foundations must stipulate in their charter that any subsequent conversion or transfer of endowed property for investment abroad must comply with FEA rules.

- As a separate legal entity, assets transferred before a creditor's claim arises are beyond the reach of claims against the Founder. It is essential that asset transfers:

- Occur before the accrual of the creditor's cause of action

- Happen within two (2) years from the date of registration

- Do not render the Founder insolvent

- Are conducted without any intent to defraud the creditor.

- Creditors’ claims Being a separate legal entity, if the transfer of assets was completed prior to the claim arising, the assets are beyond the reach of a creditor’s claim against the Founder. It is important that the transfer of assets:

- takes place before the creditor’s cause of action is accrued

- takes place two (2) years from the date of registration

- must not render the Founder’s insolvent; and

- must be made without any intent to defraud the creditor

- All accounting and other records of the Labuan Charitable Foundation must be maintained in Labuan and made available for inspection by council members, supervisory personnel, officers, and the appointed auditor, if any.

- Operations of a Labuan Islamic Charitable Foundation must adhere to Shariah principles.

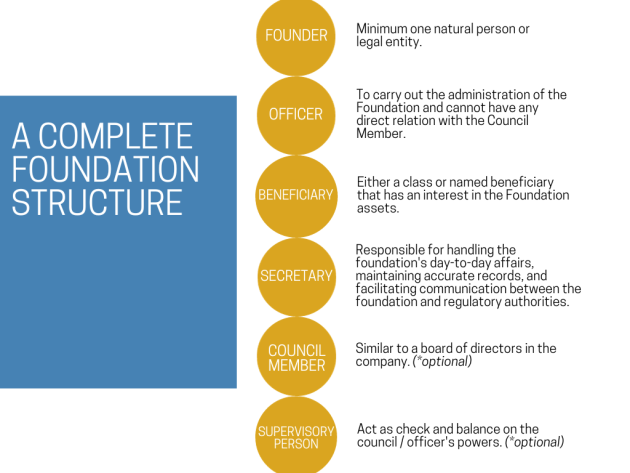

Main Elements and Keys individuals involved in the creation of a Labuan Charitable Foundation

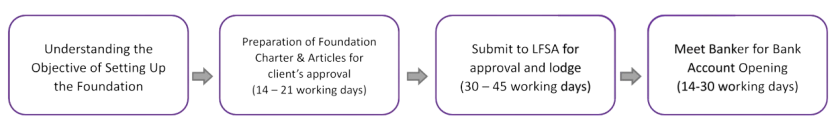

Foundation Establishment Steps

A Trust Officer will examine each case or family setup carefully. There is no one-size-fits-all setup, as every family is unique. We will advise the best possible structure that may suit you and your family. The timeframe of setting up a Foundation depends on the complexity of the Founder’s wishes and family needs.

About FAA Advisory Limited

Comprising a team of seasoned professionals well-versed in Labuan's business landscape, FAA Advisory Limited extends a comprehensive suite of services covering corporate services, private wealth management, and licensing compliance administration, all tailored to meet the unique needs of our clients.

At FAA Advisory Limited, our expertise lies in delivering Labuan insights that facilitate business expansion, simplifying intricate processes, and offering valuable information to guide you through various facets of your journey.

Choose FAA Advisory as your trusted partner in navigating the dynamic business landscape of Asia. With our commitment, we are your gateway to success in Labuan and beyond.

Email: advisory@finarkasia.com | Phone number: +6010-931 6678