In a competitive business landscape, safeguarding assets while nurturing growth remains an ongoing challenge. Labuan's Limited Partnerships (LPs) and Limited Liability Partnerships (LLPs) emerge as pivotal solutions tailored to streamline business operations while ensuring asset protection and operational flexibility. Labuan's partnership structures redefine success by bridging the gap between security and expansive growth, ensuring your venture thrives in a constantly evolving business environment.

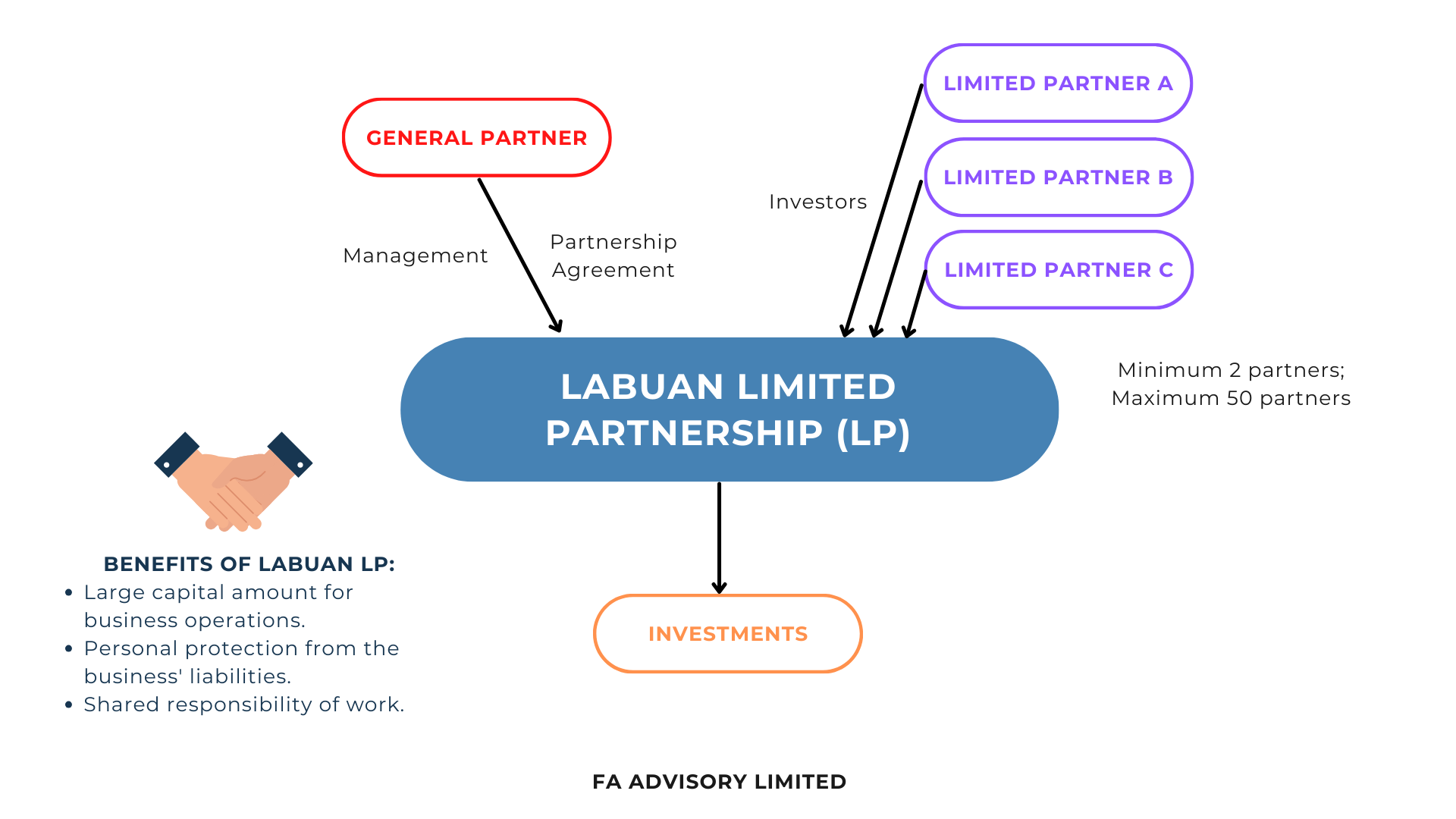

Labuan Limited Partnership (LP)

A Labuan limited partnership (LP) entails a partnership structure of two or more partners operating or managing a business together with distinct roles: at least one general partner and one limited partner. With a maximum of up to 50 partners, LPs offer diverse funding possibilities and profit sharing. While general partners manage daily operations, limited partners enjoy a shield from direct liabilities unless engaged in managerial roles.

The partners of LPs may be a corporation except for those which are set up for professional practice, in which it must consist of natural persons only and supplemented with professional indemnity insurance coverage.

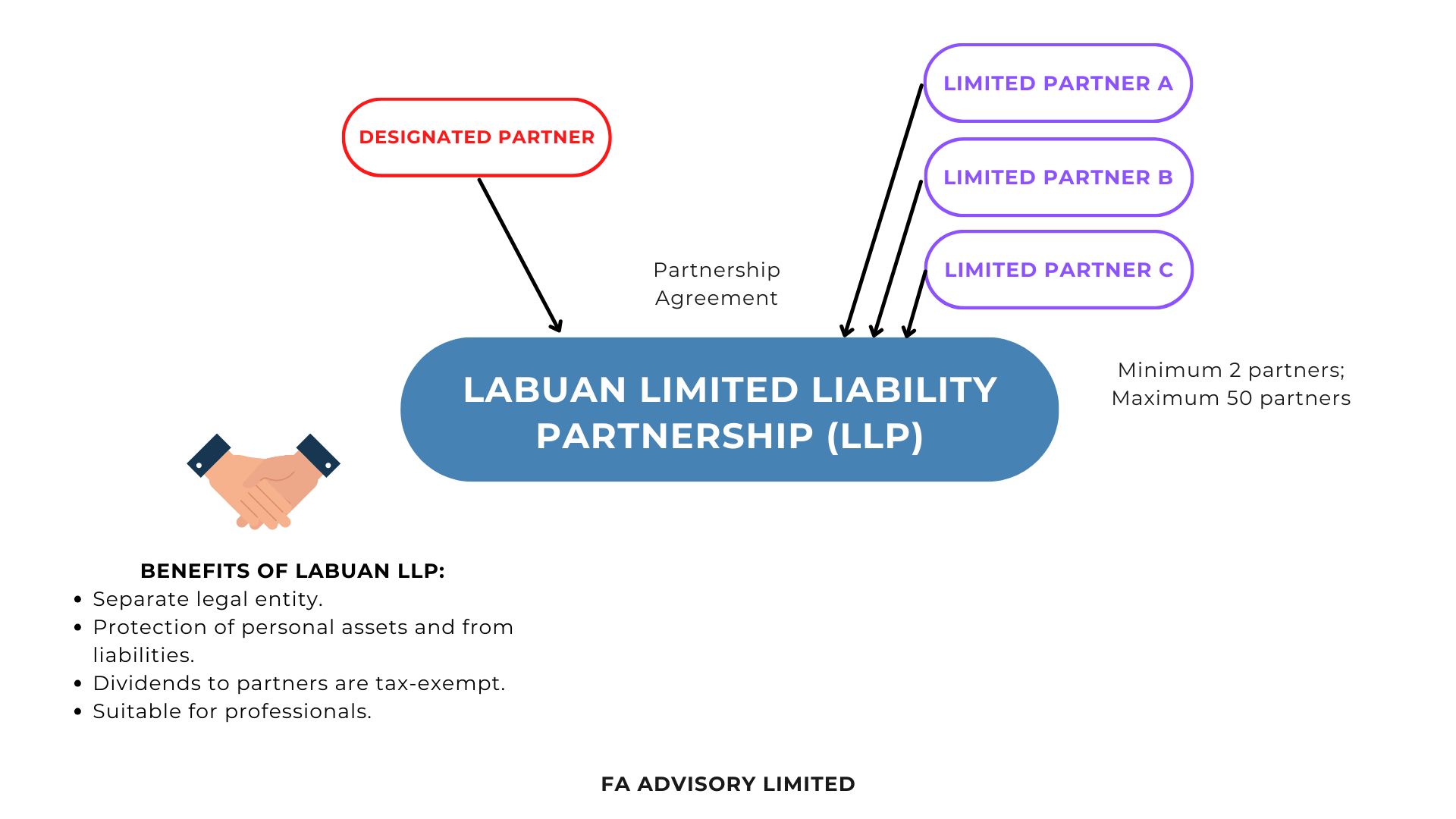

Labuan Limited Liability Partnership (LLP)

A Labuan limited liability partnership (LLP) stands as an alternative corporate business structure, combining the benefits of limited liability of a company with the flexibility of a partnership. LLPs offer partners the ability to engage in contracts and acquire, own, hold and develop or dispose property under their individual names.

To form a Labuan LLP, a minimum of two partners is required – one designated partner and one limited partner.

A Labuan LLP is a business entity designed to shield partners from the liabilities incurred by the misconduct of another partner.

- This structure shields members from personal liabilities, except to the extent of their investment in the Labuan LLP and the terms in the partnership agreement.

- While the Labuan LLP is subject to income tax, the distribution of partners’ dividends is tax-exempt.

- This structure is particularly advantageous for professionals, safeguarding partners from personal liability stemming from other partners' incompetency, error, and omission.

General Partner

A general partner has all the rights and powers and is thus subject to all the restrictions and liabilities of a partnership. The general partner has full management control over the company’s daily operations; shares the right to use partnership property; shares the profits of the firm in predefined proportions; and has joint and several liability for the debts of the partnership.

Limited Partner

A limited partner shall contribute capital to the partnership but not participate in the daily operations of the partnership and in return get a share in the profit of the business, acting similarly to an investor. The limited partner shall not be liable as a general partner unless being involved in the management of the Labuan LP.

Ready to find out more?

Drop us an enquiry today and our consultant will be in touch with you!

Benefits of Registering a LP or LLP in Labuan

Strategic location to tap into the Asia Pacific market

Shared time zone with major Asian cities for seamless interaction

Excellent infrastructure and regulations within the Labuan IBFC

OECD whitelist jurisdiction status

Recognised by prominent exchanges for entity listing (such as Hong Kong, Singapore, Malaysia, Australia, and Dubai Exchanges)

100% foreign ownership with a minimum requirement of 1 shareholder and 2 directors

Low corporate tax rate of 3%

Absence of withholding tax, stamp duty, GST, import duty, sales or service tax, capital gains tax, inheritance tax

Void of tax on dividends to shareholders

Void of tax on director fees for foreign directors

Registration Requirements for a Labuan LP and a Labuan LLP

- Appoint a Labuan trust company for the registration, which would conduct due diligence on the applicant. All documents that are required to be submitted to Labuan FSA must be filed through a Labuan trust company.

- A Labuan LP shall have the words “Limited Partnership”, “Ltd.P.”, “LP” or “L.P” as part of its name.

- A Labuan LLP shall have the words “Labuan Limited Liability Partnership”, “(Labuan) L.L.P.” or “Labuan LLP” as part of its name.

*any other abbreviations in Romanised characters which connotes a liability partnership / limited liability partnership may be approved by Labuan FSA.

Documents required for the Registration of a Labuan LP and a Labuan LLP

1

Form 1 - Application for Registration of a Labuan Limited Partnership; or

2

Form 10 - Application for Registration of a Labuan Limited Liability Partnership.

3

Certified copy of the Partnership Agreement.

- Consultation on eligibility and procedural guidance tailored to your profile.

- Profiling, due diligence and guidance on documentation preparation.

- Preparation of Business Plan, Financial Forecast and Operation Manuals.

- Submission and supervision of the application process until approval.

- Acting as your liaison and contact point with LFSA, arranging for interviews (if any).

- Tracking the license approval and handling all queries from LFSA.

- Advisory services on the appropriate company structure post-approval.

- Assistance in setting up onshore and offshore bank accounts.

- Assistance in establishing operational and marketing or co-located offices.

- Staff provision and office space rental.

- Internal audit and compliance advisory.

About FAA Advisory Limited

Comprising a team of seasoned professionals well-versed in Labuan's business landscape, FAA Advisory Limited extends a comprehensive suite of services covering corporate services, private wealth management, and licensing compliance administration, all tailored to meet the unique needs of our clients.

At FAA Advisory Limited, our expertise lies in delivering Labuan insights that facilitate business expansion, simplifying intricate processes, and offering valuable information to guide you through various facets of your journey.

Choose FAA Advisory as your trusted partner in navigating the dynamic business landscape of Asia. With our commitment, we are your gateway to success in Labuan and beyond.

Email: advisory@finarkasia.com | Phone number: +6010-931 6678