About Labuan Money Broking License

Discover Labuan, the thriving financial jurisdiction at the heart of Asia, offering several advantages for forex brokers. Boasting a 3% corporate tax rate and robust compliance regulations facilitating bank account openings, Labuan stands as a premier licensing hub globally.

For seasoned forex brokers, initiating a brokerage business mandates securing a forex license, and Labuan emerges as the prime choice. Even if you possess a forex license from another jurisdiction, Labuan beckons as the gateway to expanding into the lucrative Asian market and beyond.

Due to rapid developments emerging in the financial sector, the importance of the presence of intermediaries such as money brokers is key for ensuring that the money market and foreign exchange transactions are carried on in an effective and efficient manner to safeguard the soundness of the financial system.

Labuan Money Broking business is defined as the business of arranging transactions between buyers and sellers in the money or foreign exchange markets, acting as an intermediary in consideration for brokerage fees paid or to be paid. This excludes the buying or selling of Ringgit or foreign currencies as a principal in these markets.

A Labuan Money Broking License can be further enhanced by incorporating cryptocurrencies and e-wallet to facilitate a broader spectrum of trading activities. In other words, a Labuan Money Broking License can be used to undertake both forex trading and cryptocurrency exchange businesses.

Permissible Labuan Money Broking Activities

In carrying on the money broking or forex broker business, the licensee is expected to:

- bring together the counterparties on mutually acceptable terms for the same financial products in money or foreign exchange markets to facilitate the conclusion of a transaction; and

- receive payment for its services in the form of brokerage or commission fees. The fees charged must be adequate and appropriate; and

- act as a mediator and strictly not permitted to act as a principal in transactions.

Why Choose Labuan

There are many other jurisdictions available for forex license application, such as Cyprus, Malta, Hong Kong, Singapore, and others. Among them, Labuan may be considered as one of the cheapest, fastest, and most flexible jurisdictions.

Can conduct Innovative Digital Business with the plugin of e-wallet or digital wallet tools

Can design and trade all of the following in one platform

- fiat to fiat

- fiat to crypto

- crypto to fiat

- crypto to crypto

Low licensing and operating maintenance fee

Short application timeframe

Signed MOU with China Banking and Insurance Regulatory Commission (CBIRC) for greater collaboration

Strategic location to tap into the Asia Pacific market

Shared time zone with major Asian cities for seamless interaction

Excellent infrastructure and regulations within the Labuan IBFC

OECD whitelist jurisdiction status

Recognised by prominent exchanges for entity listing (such as Hong Kong, Singapore, Malaysia, Australia, and Dubai Exchanges)

100% foreign ownership with a minimum requirement of 1 shareholder and 2 directors

Low corporate tax rate of 3%

Absence of withholding tax, stamp duty, GST, import duty, sales or service tax, capital gains tax, inheritance tax

Void of tax on dividends to shareholders

Void of tax on director fees for foreign directors

Eligibility Criteria for Labuan Money Broking License

1

Individual or institution with money broking expertise and a good track record of at least 3 years in the field.

2

Regulated money broker or provider of such services from other jurisdictions with approval from home authority with the letter of awareness or consent.

3

Any licensed institutions including approved money brokers under the Financial Services Act 2013 with approval from the Central Bank of Malaysia.

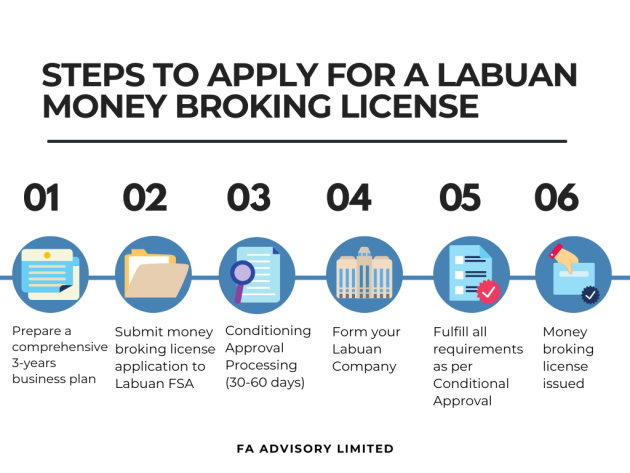

Application Process of a Labuan Money Broking License

Licensing & Operational Requirements of a Labuan Money Broking License

- Maintain a minimum paid-up capital of MYR 500,000 or its equivalent in any foreign currency, unimpaired by losses with a certificate of evidence from the banks in Labuan.

- Maintain an operational office in Labuan with a minimum of 2 full-time employees and a minimum annual spending of MYR 100,000.

- Conduct transactions in any foreign currency except the Ringgit currency. All transactions must be done to, through and from Labuan.

- Prohibits transactions with Malaysian residents, excluding authorized dealers approved by the Malaysian Exchange Control.

- Impose a maximum leverage limit of 100:1 on clients' trading transactions (i.e. a minimum of 1% margin deposit for initiating trade positions).

- Appoint a principal broker, liquidity provider, and trading platform provider, who must be regulated by a recognised supervisory or authority. Copies of agreements are required.

- Appoint an approved auditor in Labuan.

- Where technology client interface is deployed, any intrusions or malfunctions of the systems incidents discovered with the root cause and impact analysis report must be submitted to Labuan FSA within 14 days.

- Maintain a separate account for clients' funds and client's withdrawal has to be completed within 3 working days.

- Adhere to compliance requirements of the Anti-Money Laundering/Counter Financing of Terrorism (AML/CFT) Act and Guidelines issued by the Central Bank of Malaysia and Labuan Authority and employ a dedicated compliance officer.

- Consultation on eligibility and procedural guidance tailored to your profile.

- Profiling, due diligence and guidance on documentation preparation.

- Preparation of Business Plan, Financial Forecast and Operation Manuals.

- Submission and supervision of the application process until approval.

- Acting as your liaison and contact point with LFSA, arranging for interviews (if any).

- Tracking the license approval and handling all queries from LFSA.

- Advisory services on the appropriate company structure post-approval.

- Assistance in setting up onshore and offshore bank accounts.

- Assistance in establishing operational and marketing or co-located offices.

- Staff provision and office space rental.

- Internal audit and compliance advisory.

About FAA Advisory Limited

Comprising a team of seasoned professionals well-versed in Labuan's business landscape, FAA Advisory Limited extends a comprehensive suite of services covering corporate services, private wealth management, and licensing compliance administration, all tailored to meet the unique needs of our clients.

At FAA Advisory Limited, our expertise lies in delivering Labuan insights that facilitate business expansion, simplifying intricate processes, and offering valuable information to guide you through various facets of your journey.

Choose FAA Advisory as your trusted partner in navigating the dynamic business landscape of Asia. With our commitment, we are your gateway to success in Labuan and beyond.

Email: advisory@finarkasia.com | Phone number: +6010-931 6678