A Labuan entity must complete the following annual matters to maintain its operation in Labuan, if applicable:

[wptb id=988141]

Annual Return

Information of the Company to be confirmed by the Board of Directors annually includes:

- Date of Incorporation

- Information on Share Capital

- Location of Registered Office

- Nature of Business

- List of the latest Directors, Secretaries, Auditors, Managers, Committees, Investment Managers and Nominees/Trustees

- Total amount of indebtedness

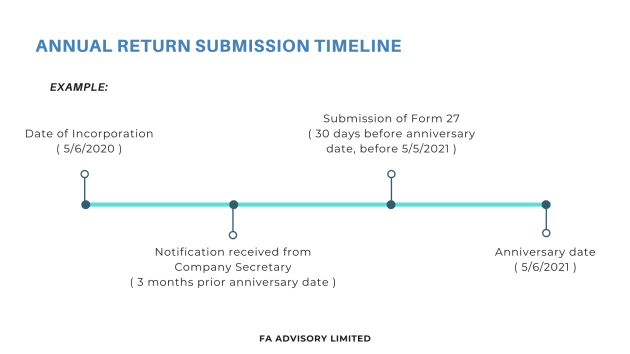

Submission timeline is appended as below:

Audited Financial Statement

Entities that are required to submit its audited financial statement would be required to appoint only a Labuan-approved auditor to carry out the external audit function on the company’s account.

The appointment of the external auditor will have to go through the company’s due diligence procedures and finally be subject to the Board of Director’s approval.

Internal Audit Report

The purpose of internal audit report is to monitor the company’s compliance with the following Acts, Guidelines and Policies:

- Labuan Companies Act 1990, Labuan Business Activity Tax Act 1990, Anti-Money Laundering Act 2001, and other relevant legislations.

- Guidelines, directives, and circulars issued by Labuan FSA and pronouncements or rules issued by relevant associations.

- Internally approved policies and operational procedures. For example, FA Advisory's policies cover risk management policy, policy on fit and proper criteria, compliance manual and so on.

About FAA Advisory Limited

Comprising a team of seasoned professionals well-versed in Labuan's business landscape, FAA Advisory Limited extends a comprehensive suite of services covering corporate services, private wealth management, and licensing compliance administration, all tailored to meet the unique needs of our clients.

At FAA Advisory Limited, our expertise lies in delivering Labuan insights that facilitate business expansion, simplifying intricate processes, and offering valuable information to guide you through various facets of your journey.

Choose FAA Advisory as your trusted partner in navigating the dynamic business landscape of Asia. With our commitment, we are your gateway to success in Labuan and beyond.

Email: advisory@finarkasia.com | Phone number: +6010-931 6678