Discover the Labuan Advantage for Fund Managers

In the UK and USA, a Hedge Fund license is required for fund managers, while in Singapore and China,the establishment of a Fund Management Company (FMC) for asset management purposes is required. Contrarily, Labuan introduces a distinctive landscape where a Fund Manager, a professional housed within a business entity, manages funds on behalf of the business for investments or trading purposes.

Defined by the Labuan FSA, a Labuan Fund Manager is a person who provides management services which may include investment advice or administrative services in respect of securities for the purposes of investment, including dealing in securities. For those venturing into Islamic fund management, its fund management operations shall comply with Shariah principles. Any Labuan Company aspiring to delve into fund management must secure the requisite licensing.

When setting up a Labuan Mutual Fund, it is compulsory for a Labuan Public Fund but optional for a Labuan Private Fund, to appoint a Labuan Fund Manager to manage the fundraising and investment activities of the fund.

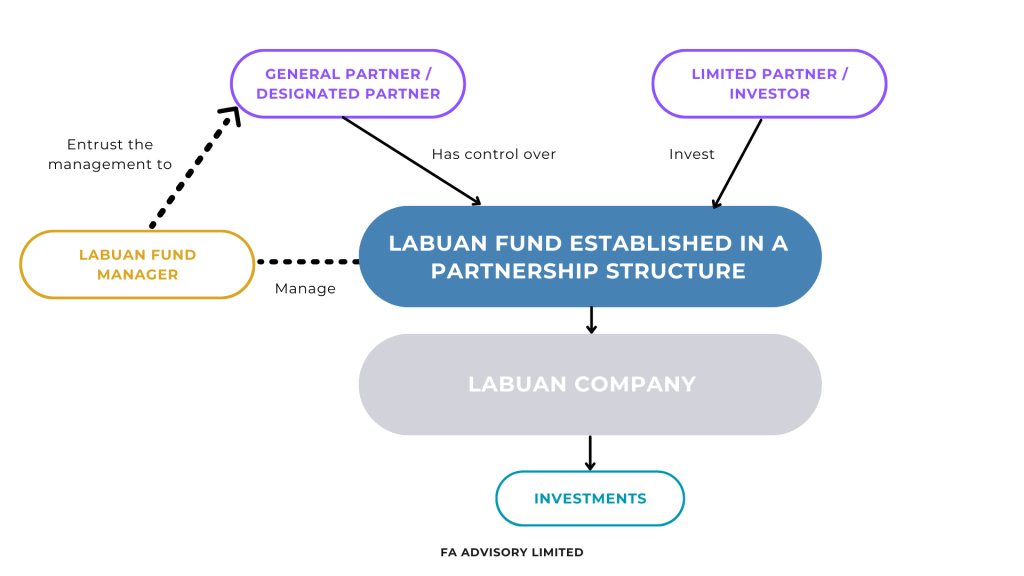

As shown in the structure below, it is evident that the licenses and company structures available in Labuan can be combined to meet the needs of your desired business. For instance, you may choose to set up a Labuan Fund (either public or private) in the structure of a business Partnership to make strategic domestic and/or foreign investments, with a minimum requirement of 2 partners. Alternatively, you may choose to set up any company structure that suits best with the Fund Management Company or Fund you would like to establish.

Labuan unfolds a tapestry of possibilities, where licensing and structures can be combined to align with your business aspirations.

Why Choose Labuan

Compared to different jurisdictions with similar fund management licenses, Labuan has the lowest tax rate with the shortest application time frame. Located in the center of Asia, with easy accessibility that easily connects to the ASEAN region, Labuan is recognized by the region. A Labuan company can be listed on Hong Kong, Singapore, Dubai and Australia Stock Exchange Market. In the year 2018, Labuan Authority signed an MOU with the China Banking and Insurance Regulatory Commission (CBIRC) for greater collaboration. With the great effort of the authority, Labuan Fund Manager has a more significant opportunity to conduct their business across the region.

Labuan Fund Manager License enables the adoption of fintech and AI technology in the fund management business.

Strategic location to tap into the Asia Pacific market

Shared time zone with major Asian cities for seamless interaction

Excellent infrastructure and regulations within the Labuan IBFC

OECD whitelist jurisdiction status

Recognised by prominent exchanges for entity listing (such as Hong Kong, Singapore, Malaysia, Australia, and Dubai Exchanges)

100% foreign ownership with a minimum requirement of 1 shareholder and 2 directors

Low corporate tax rate of 3%

Absence of withholding tax, stamp duty, GST, import duty, sales or service tax, capital gains tax, inheritance tax

Void of tax on dividends to shareholders

Void of tax on director fees for foreign directors

Eligibility Criteria for Labuan Fund Manager License

1

Any individual who holds a relevant degree or professional qualification to carry on fund management activities will be eligible. Applicants with at least a minimum qualification of diploma holder and 3 years’ relevant experiences in the capital market or direct experiences in fund management activities may also be considered.

2

Approved fund manager or any provider of such services from a country or jurisdiction who is a member of the International Organization of Securities (IOSCO).

OR

Anyone who does not fulfill (1) and (2) may also be considered, provided that the fund management activities are run and managed by suitably qualified and experienced individuals.

Interested applicants may contact our team for pre-assessment on your eligibility for Labuan Fund Manager License.

Ready to find out more?

Drop us an enquiry today and our consultant will be in touch with you shortly!

Licensing & Operational Requirements of a Labuan Fund Manager License

Management Services

- Act or offer to act as the portfolio manager on behalf of the clients for a portfolio of securities including funds and any foreign funds that has been approved by its home regulator of an IOSCO member country.

- Manage activities in the acquisition or disposal of a portfolio of securities including funds and any foreign funds that has been approved by its home regulator of an IOSCO member country.

- Manage clients’ discretionary accounts including Labuan Mutual Fund.

Investment Advisory

- Conduct securities analysis and make investment recommendations based on the client's investment objectives and financial situation.

- Provide securities advice including the issuance or promulgation of research report and analysis.

- Provide consultancy and advisory services related to corporate finance and financial planning matters for corporate clients.

Administrative Services

- Make submissions on behalf of clients to Labuan FSA in respect of securities including any other reporting requirements and issuance of documents which are deemed to be prospectuses.

Dealing in Securities

- Quote two-way prices and deal in securities.

- Arrange for the sale or purchase of securities including those that are not listed on a stock market of a stock exchange, issued by, belonging to or on behalf of clients.

- Underwrite securities and placement out of such underwritten securities to commensurate with the adequacy of its financial resources.

- Other dealing in securities as permitted by Labuan FSA.

- Maintain a minimum paid-up capital (unimpaired by losses) of MYR 300,000 or its equivalent in any foreign currency. Where the Labuan Fund Manager has Asset Under Management (AUM) of more than MYR 150 million, an additional capital equivalent to 0.2% of the AUM in excess of MYR 150 million is requisite.

- Maintain the professional indemnity insurance policy with coverage of not less than MYR 1 million or its equivalent in any foreign currency.

- Establish an operational office in Labuan with a minimum of 2 full-time employees and a minimum annual spending of MYR 100,000. A Labuan Fund Management Company may set up a marketing office anywhere in Malaysia.

- Ensure the compliance of the duties of a Labuan fund manager including segregation of client’s assets.

- Implement adequate internal policies and procedures for its operations, compliance, internal controls, corporate governance, and risk management, including its business continuity plan. These have to be regularly reviewed to ensure that they remain appropriate, relevant and prudent.

- Appoint an approved auditor based in Labuan. The audited report is to be submitted within 6 months after the end of a financial year.

- Conduct business transactions in any foreign currency except Ringgit currency. Transactions in Ringgit are only permitted where the purpose of the transaction is to defray expenses.

- Notify Labuan FSA in writing any amendment or alteration to any of its constituent documents or business plan within thirty (30) days of the changes being effected.

- Comply with the Anti-Money Laundering and Anti-Terrorism Financing Act 2001 and Guidelines on Anti-Money Laundering and Counter Financing of Terrorism relevant to Labuan IBFC.

- Consultation on eligibility and procedural guidance tailored to your profile.

- Profiling, due diligence and guidance on documentation preparation.

- Preparation of Business Plan, Financial Forecast and Operation Manuals.

- Submission and supervision of the application process until approval.

- Acting as your liaison and contact point with LFSA, arranging for interviews (if any).

- Tracking the license approval and handling all queries from LFSA.

- Advisory services on the appropriate company structure post-approval.

- Assistance in setting up onshore and offshore bank accounts.

- Assistance in establishing operational and marketing or co-located offices.

- Staff provision and office space rental.

- Internal audit and compliance advisory.

About FAA Advisory Limited

Comprising a team of seasoned professionals well-versed in Labuan's business landscape, FAA Advisory Limited extends a comprehensive suite of services covering corporate services, private wealth management, and licensing compliance administration, all tailored to meet the unique needs of our clients.

At FAA Advisory Limited, our expertise lies in delivering Labuan insights that facilitate business expansion, simplifying intricate processes, and offering valuable information to guide you through various facets of your journey.

Choose FAA Advisory as your trusted partner in navigating the dynamic business landscape of Asia. With our commitment, we are your gateway to success in Labuan and beyond.

Email: advisory@finarkasia.com | Phone number: +6010-931 6678